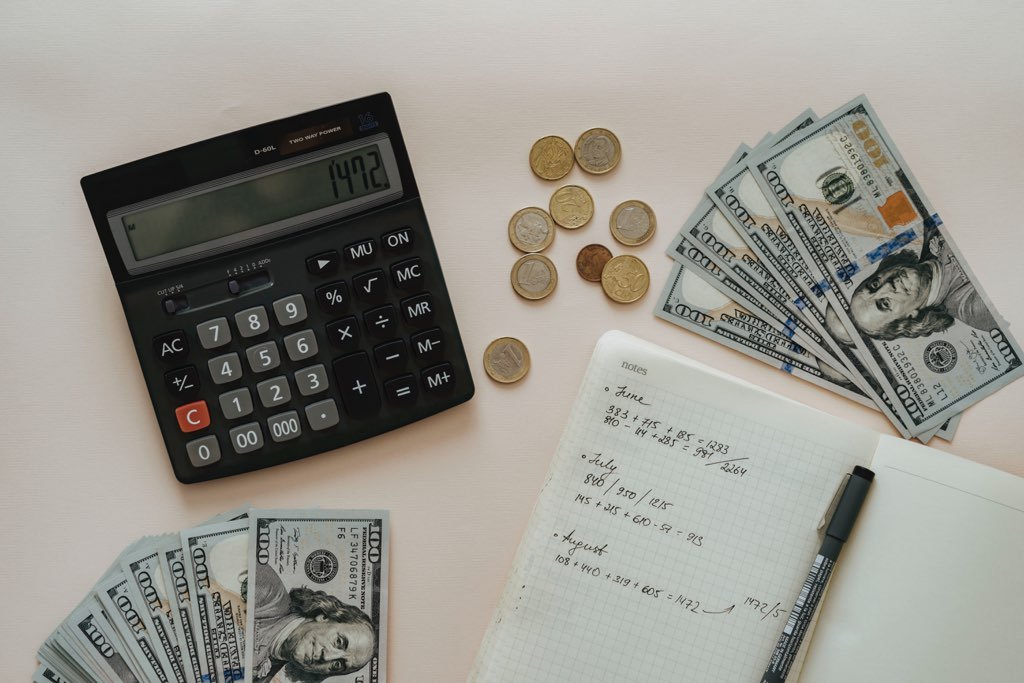

Budgeting

Budgeting… the unsung financial hero.

We often praise high FICO credit scores, low-interest rates for cars/homes, high credit card limits, and being able to be approved for practically anything. We rarely praise the most important tool we have… Budgeting.

Budgeting is the unsung financial hero we rarely praise. Let’s review the benefits of budgeting:

100% control of your own money

Keeps you focused on your money goals

Organization of where you save, invest and spend money

Enables you to withstand the unexpected financial life events

Enables you to produce more money

Enables you to determine if you can take on additional debt

Helps you eliminate the opportunity of spending what you don’t have

Provides you the peace of mind knowing you’re covered financially

There are plenty of budgeting strategies to choose from. There isn’t a “one size fits all” plan so pick the one that best suits you! Once selected, tailor the strategy to compliment your current situation and financial goals. Below are my top 4 budgeting strategies:

Ultimately, having a poor budgeting strategy will leave you susceptible to the many unplanned financial expenses we have. First, you save, then you invest, and finally, you should spend. Let’s simplify this.

Debt Tackling

There are two proven methods when it comes to tackling debt for personal finance. The strategies are the snowball and avalanche method.

Financial Goal Setting

.It’s natural to feel overwhelmed, discouraged and even defeated when thinking about money and financial goals.

Zero Based

Zero based budgeting is a strategy that helps align spending with financial goals. This approach requires you to build your budget from scratch each month to help verify that all expenses are accounted for and disbursed.

50/30/20

The 50/30/20 budget is one of the simplest yet effective strategies for adults.

Envelope

The envelope budgeting strategy is a simple yet diligent approach to managing money. This method is a tried-and-true cash-based budgeting system.

Pay Yourself First

The “pay yourself first” budgeting strategy is a method that forces an individual to contribute to a retirement account, emergency fund, savings account, or other savings vehicle FIRST.

Creative Savings Strategies

Saving money is tough. Maybe you aren’t earning enough, your current financial obligations has exceeded your income, or you just need extra cash. When the traditional methods aren’t adding up, this is where we have to get creative to hit your financial goals. Here’s a list of our top proven strategies.

Passive Income

.Another way to accelerate your savings plan is to create passive income. Passive income is a great supplementary source of funds for many people, and it can prove to be an especially valuable lifeline.